vermont state tax exempt form

The applicant must furnish one of the following proofs of ownership in order of preference. You may file up to Oct.

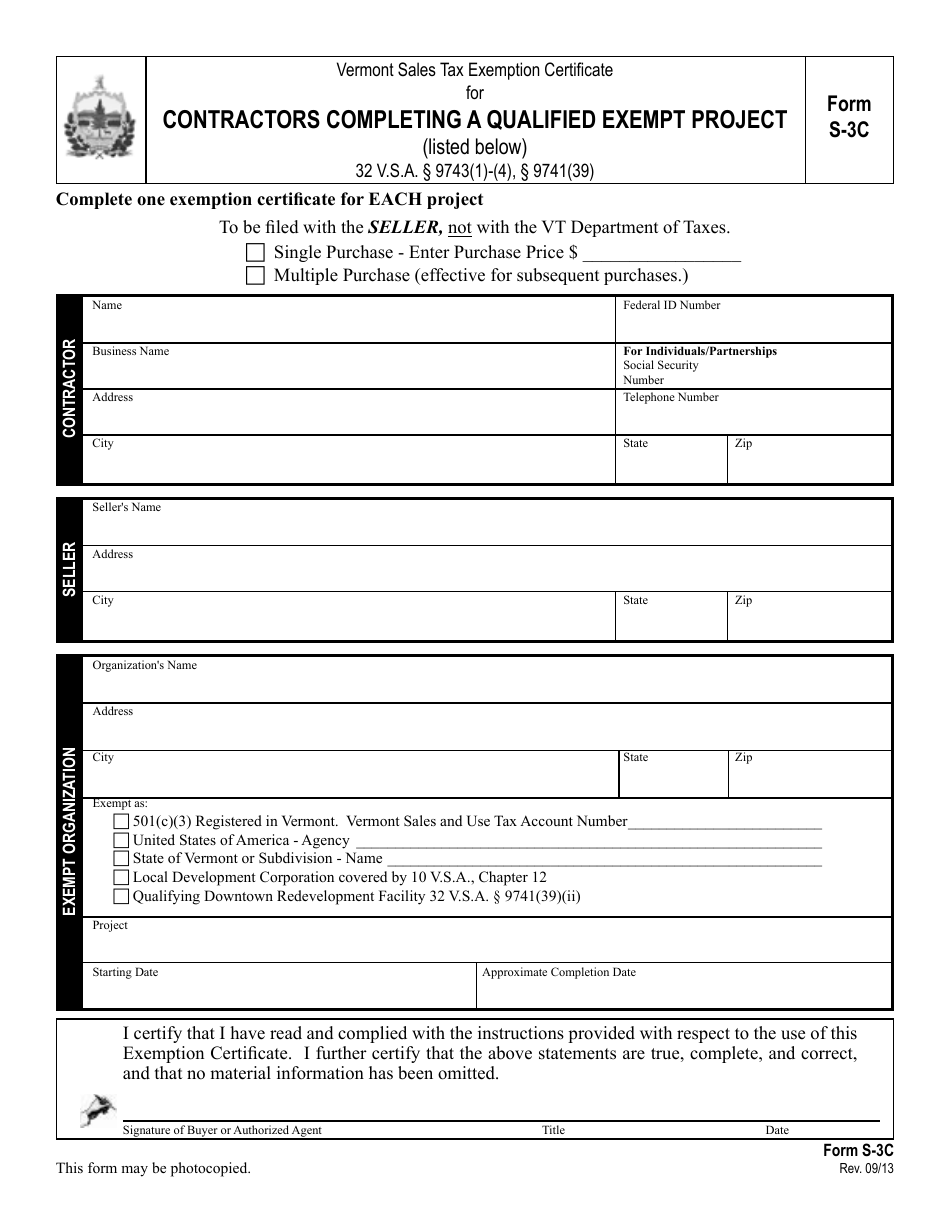

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

IN-151 Application for Extension of Time to File Form In-111 Vermont Individual Income Tax Return.

. In most cases tax-exempt resale certificates are given to businesses and organizations that purchase goods with the prospect of reselling or using them for the creation of goods or services to be sold to clients. A tax-exempt resale certificate is a form of documentation that permits a buyer that owns it the liberty to not pay sales for the purchase of specific goods from sellers. Calculator xlsx Underpayment of 2020 Estimated Individual Income Tax.

An original or a certified copy of a previous Vermont or out-of-state registration indicating the applicants ownership. Vermont Tax Adjustments and Nonrefundable Credits. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

Sufficient evidence of ownership as. Please note that the tax exemption information provided is the most current information as of the date indicated on each individual State map page bottom left. Registration Tax Title Form form VD-119.

How to file a Homestead Declaration. For details on late filing see the instructions. Vermont Department of Taxes 211221100 2021 Form HS-122 Vermont Homestead Declaration AND Property Tax Credit Claim 2 1 1 2 2 1 1 0 0 DUE DATE.

Please complete Section A of this form sign in the. Vermont Credit for Income Tax Paid to Other State or Canadian Province. A previous Vermont or out-of-state title indicating the applicants ownership.

15 2021 but the town may assess a penalty. Did you recently receive a 1099-G Form from the Vermont Department of Labor. Click on the state below where you will be traveling to or purchasing from to find out if that state exempts state taxes and what the requirements are for example many states require a Government ID or a form.

If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website.

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Printable Vermont Sales Tax Exemption Certificates

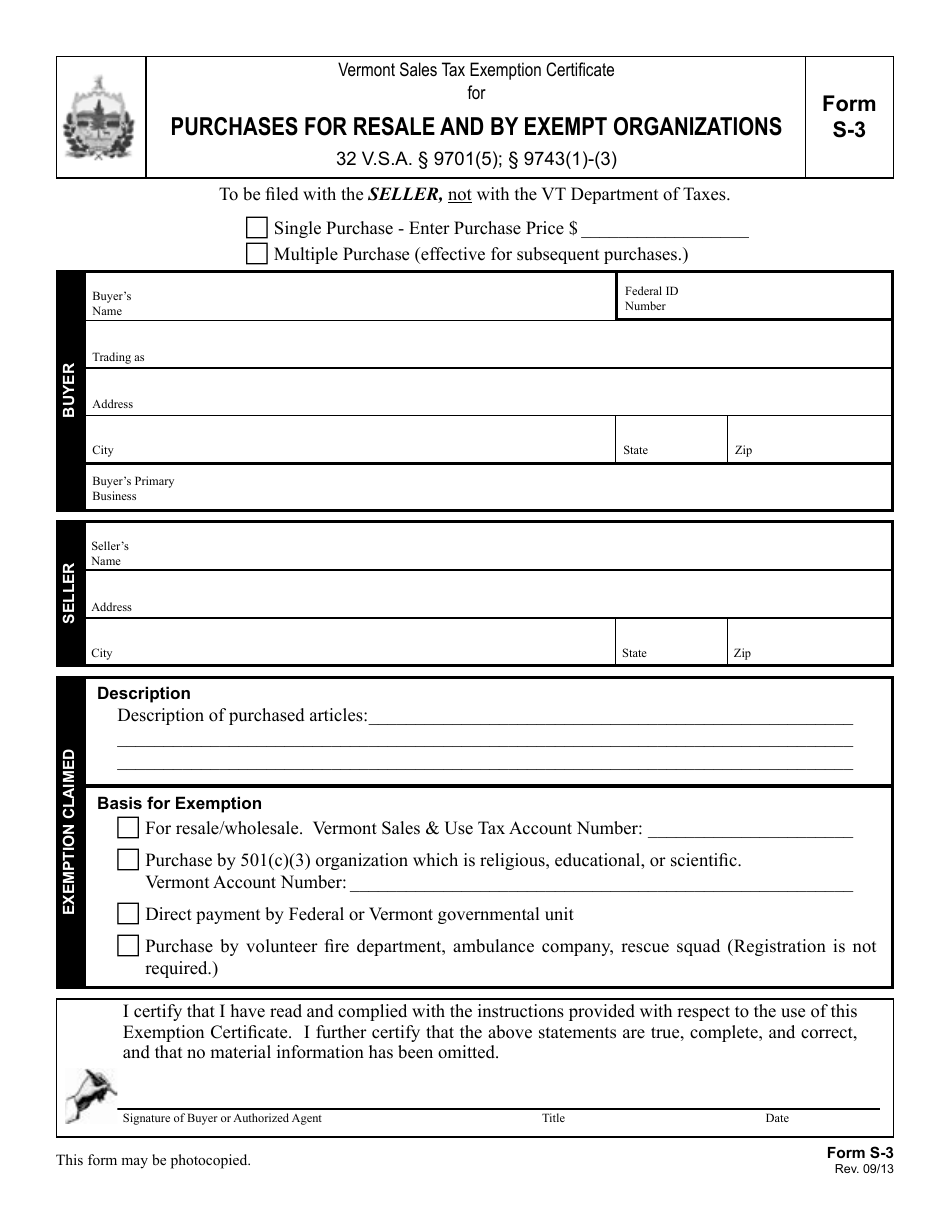

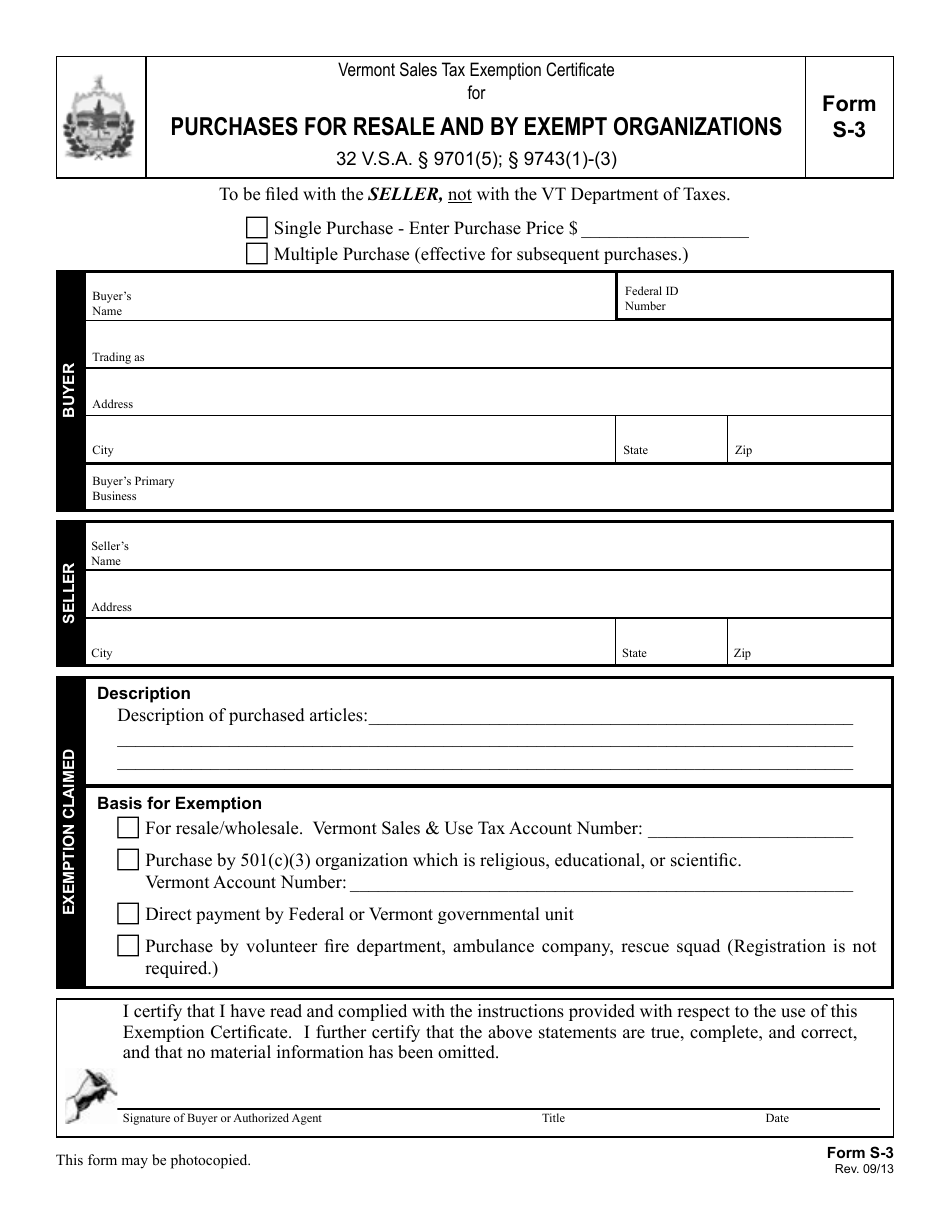

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

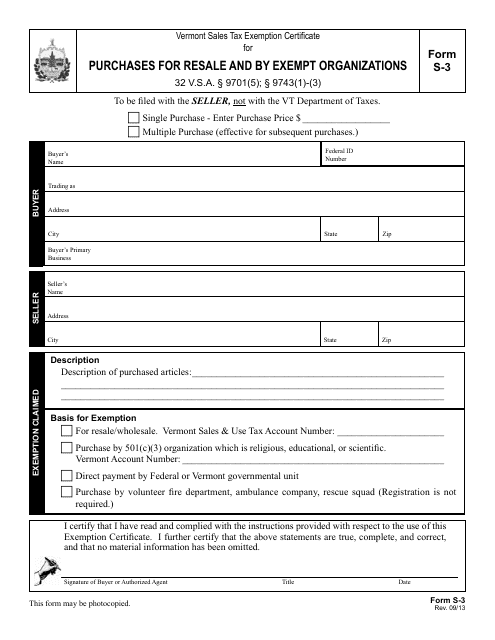

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller